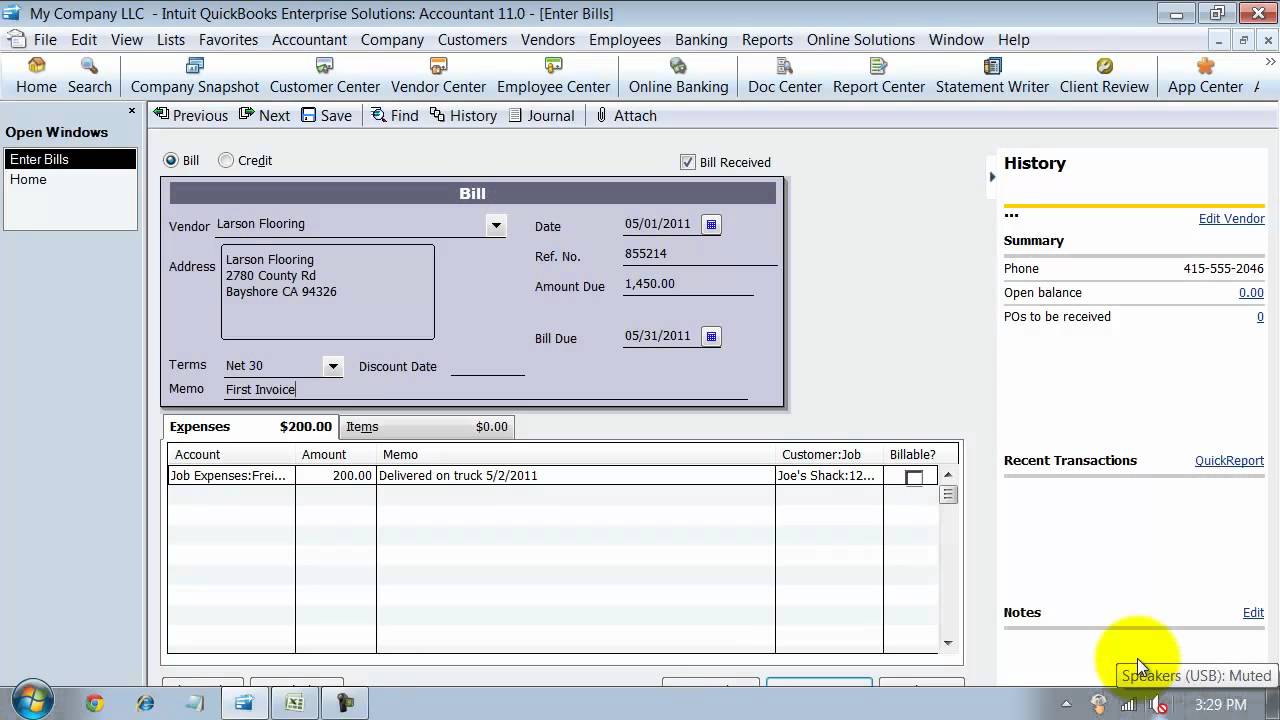

If its scheduled or a reminder, then you will also choose how many days in advance it should be created. Here you will have the options to set the type of recurring bill you want, such as scheduled, reminder, or unscheduled. If you choose this, extra options will appear to schedule the bill. First of all, you can make it a recurring bill by choosing Make Recurring from the link at the bottom. Once you are finished with the bill, you have several options for sharing it. Item details have extra fields for Quantity and Rate.Īt the bottom of the bill, you can add a memo as well as an attachment. Here you can enter any products or services included in the bill in much the same way that you did with Category Details. Interested in learning more? Why not take an online QuickBooks Online course?īelow Category Details are Item Details. More category details can be added on other lines, and more line can be added if needed. Updating the amount will cause the total amount for the bill to change automatically. You will then add a description and the amount that it's for. You can add a new category by clicking the Add New option in the category drop-down menu. For category, choose the expense account that it fits. If the bill has a reference number, enter that into the bill number field.īelow the vendor information, you can enter the category information for the bill. These should be changed to reflect the real dates you were billed and when it is due. The fields for the bill date and due date will be automatically filled in based on the day's date. This time, if you select a vendor, information such as the mailing address and terms will show up automatically. Once you have entered all the vendor information that you need, click the Save button to return to the form to add a bill. More information can be added about the vendor including their terms, opening balance, account number business number, whether or not payments should be tracked, and the default expense account. More contact information including email, phone, mobile, fax, website, and billing rate can be filled out on the form. Next is a section for adding your own notes about the vendor as well as including an attachment. Entering the address correctly is important if you visit the vendor using QuickBooks Online's mobile app because it will load up on your phone's map.

Confirm with the vendor what name checks should be made out to for this field.įollowing the name for checks is a field for the address. Just below the Display name is checkbox for determining if the display name is the same as the name for writing on checks. Here it is important to enter the Display name.Ībove the company name you can enter information about a contact at the company. For this example, we will click on the Details link and enter information manually.Ĭlicking the Details link will open a bigger window.

If you click the Details link, you will be taken to longer form where you can enter various information about the vendor.Īlternatively, you can add the vendor from your Gmail account if you choose to link it. Once you add the vendor, you will need to decide how you will add details about it. In the first field, enter the name of the vendor. Selecting the Add New option will pop up window where you can enter details about the vendor. In this case, let's choose to add a new vendor. If the vendor has not been added yet, you will need to click on the Add New option in the drop-down menu. Select the vendor from the Vendor drop-down.

The first thing it will ask you for is the vendor. You will now be at a screen where you can add your new bill. Then, select Bill from the Vendors category. To add a bill, you should first select the New button from the Navigation Pane. New bills from a vendor should be recorded as soon as possible so that you can pay them later when they are due. You can then use Pay Bills to create a check and clear off the bill. When you receive a bill from a utility, such as your internet provider, you should enter it into Bills even if it is not due until the end of the month. It's also necessary to track vendor balances so that you always know how much each vendor is owed. It's important to enter bills from vendors so that your Accounts Payable remains accurate. In a situation where we pay later, we use bills. When paying for a good or service, you can choose to do so immediately or pay later. In this article, we will take a look at various ways that you can keep on top of your company's expenses. Sometimes you want to use bills, while other times you should record checks or expenses. There are many different ways to pay vendors. One essential feature of QuickBooks Online is the ability to track expenses and pay bills.

0 kommentar(er)

0 kommentar(er)